Florida Land Trusts - Part 1

What is it and how do I use it?

A Florida Land Trust is a unique and perfect method to buy, sell and hold Property while limiting and separating liability and dealing with multiple partners without having to form a Partnership, LLC, or Corporation. It basically treats the property as a personal asset, but retains all of the best rules of protection for both personal and real estate and adds a few more. (as described below). There are 6 states that allow Land Trusts that contain the special features for Real Estate (Florida, Hawaii, Illinois, Indiana, South Dakota, and Virginia)

It is exceptionally simple to form and requires no federal, state or local filing or reports. A few additional benefits of holding property in a LAND TRUST instead of an LLC or other form of ownership is as follows:

A very important benefit is that you can place your existing home or investment properties into separate LAND TRUSTS (with you and/or your wife as Beneficial Owners) without causing your mortgage to be accelerated by a bank (this is Federal Law 12USA 1701J-3 )

If you live in the property, you will be able to retain your Homestead Exemptions. (this is also true holding property in a Living Trust, but in an LLC you lose those exemptions)

Your Owners Title Policy, Lenders Title Policy, and Property Insurance will remain the same and carry over in the name of the Land Trust. Transferring into an LLC will require new policies.

Because the Land Trust is treated as an asset known as a Grantor Trust, you can sell or transfer all of, or a percentage a percentage of the entire Trust to another party very quickly, quietly, and privately without having to file any documents with the county by using a simple Bill of Sale of the Land Trust (instead of a full property closing) without having to incur new closing fees, title insurance, property insurance, etc. There are two exceptions: If the equitable owners have changed, the new Trustee will have to pay a DOC STAMP FEE for the declared value of the exchange, and if the Name of the TRUSTEE changes, the old TRUSTEE will have to sign and provide a NEW WARRANTY DEED to the new Trustee, which transfers power and authority to the name of the new Trustee of the Land Trust, along with his new address for contact (filing cost about $20)

Of course YOU PERSONALLY, or any other type of organization (such as LLC, S-CORP, C-CORP, etc) can act as a TRUSTEE of the LAND TRUST, but for those who prefer to remain very private, you can form a second Land Trust (under Section 689 of Florida Statutes which allows trusts to hold or manage personal assets), and that second Trust will have NO ASSETS in it, and its sole purpose is to ONLY to act as a TRUSTEE for other TRUSTS. You are the equitable owner of the second trust (but your name is not shown in any county record), and the name of the second Trust is shown as TRUSTEE on the original LAND TRUST. Of course, any authorized party within the second Trust (you or a designated agent) can sign as an agent for the TRUSTEE on matters related to the original LAND TRUST.

THERE ARE 2 DOCUMENTS AND 2 (OR MORE) PARTIES TO A LAND TRUST

1- The Equitable Owners of the Land Trust, who can be an Individual, a Family Living Trust, a Self-Directed IRA, Two Separate self directed IRA’s (Husband and Wife IRA’s) each holding 50% ownership, a Group of Unrelated Individual Investors, a Limited Liability Company (LLC), S-Corp, C-Corp, or Partnership. No matter who they are, each one holds a share of the LAND TRUST equal to their cash (or other) contribution.

2- The Operating Agreement – Which is drawn up among the Equitable Owners states how the Land Trust will be organized, how much percentage of ownership each equitable owner holds, who will MANAGE it, and who will be the TRUSTEE .This is a private non-public document that should be Signed and Notarized by all Equitable Owners and Trustee., and copies provided to each person. It is not required by law to be filed in the county records, and you should not do so, since it will provide a level of privacy for all the Owners. You can name the Land Trust anything you want, such as 123 Main Street Land Trust, Sunshine Land Trust #1, etc, and you do not have to register a fictitious name with the state because you are declaring a TRUST in the Warranty Deed

3- The Trustee – This is the person that holds technical title (but not Equitable Title) to the Land Trust, and is responsible for signing all legal documents to transfer title at the time purchase and time of sale, and is the legal point of contact for the Trust. This is similar to when a home has a mortgage, and a Trustee has to sign paperwork or release Warranty Deeds in the future sale. In those cases a BANK (or Trustee or designated agent acting for the Bank is named) signs to transfer title. The Trustee is given limited fiduciary powers by the Equitable Owners in the written Operating Agreement, which usually involves signing deeds or documents at the specific written directions of the Equitable Owners. A Trustee can be one of the Equitable Owners, a Trusted Third Party Fried, Family Member, Business Associate, LLC, Partnership or Corporation.

4- The Warranty Deed – When the property is initially purchased the Warranty Deed is recorded in the county. There are only two names on the Deed – the Name of the LAND TRUST, and the Name of the TRUSTEE as fiduciary contact.

This is the ONLY DOCUMENT that you have to file with the County, so it formally recognizes the Name of the Trust and the Name of the Trustee. You do not need to disclose anything else, and it costs about $20 as a one time fee to have it recorded. An example is shown below

123 Main Street Land Trust, Trustee John Smith (Trustee is an Individual)

123 Main Street Land Trust, Trustee Sunshine LLC (Trustee is an Organization)

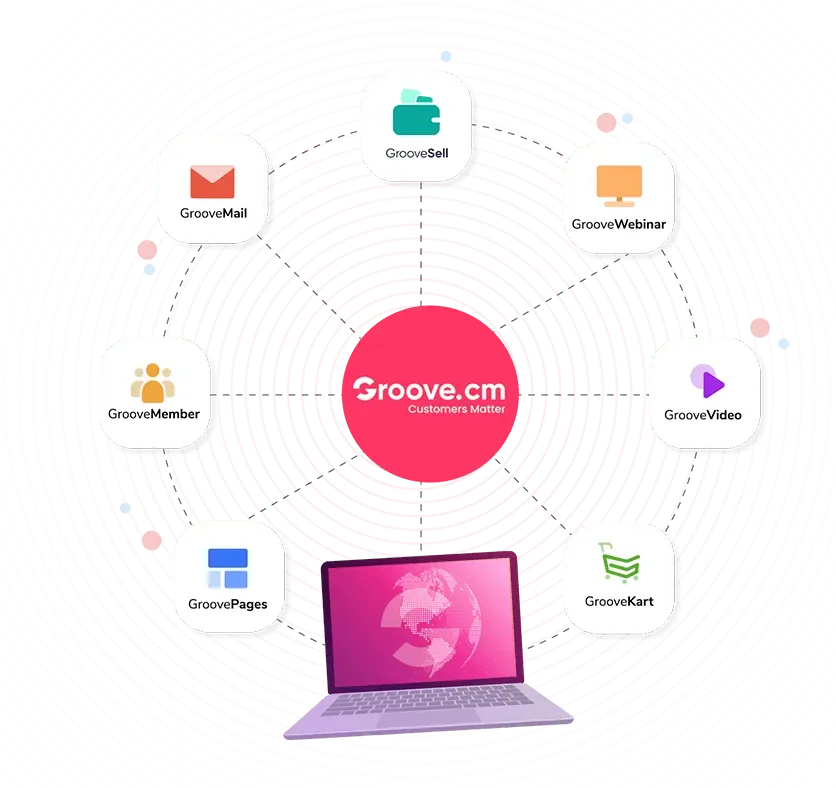

A Chart showing the Organization of a Florida Land Trust is Shown Below

FLORIDA LAND TRUST CHART www.usa1000.com

Also, Florida Land Trusts are governed under Florida Statute 689.071 and may be organized as either Personal Property (the usual choice), or Real Property, and it affects what types of laws apply.

Many people do not realize that there are several special provisions in the Florida Land Trust Statutes that serve to limit liability of each beneficial owners personal assets. Normal Revocable Trusts generally allow for full pass-thru liability under section 736 of the statutes, HOWEVER Land Trusts organized under 689.071 have several special protections for the owners and the Trustee.

Section 689.071(12) states DETERMINATION OF APPLICABLE LAW.—Except as otherwise provided in this section, chapter 736 does not apply to a land trust governed by this section.

Going forward, section 689.071 8(a) prevents liabilities and judgements against a Land Trust from being collected from individual beneficiaries personal assets. That means any judgements can only be levied against the assets INSIDE the Land Trust itself (which is usually just one property) and does not pass thru to all the owners other individual personal assets. It reads as follows:

689.071 (8)(a) LAND TRUST BENEFICIARIES.—Except as provided in this section, the beneficiaries of a land trust are not liable, solely by being beneficiaries, under a judgment, decree, or order of court or in any other manner for a debt, obligation, or liability of the land trust. Any beneficiary acting under the trust agreement of a land trust is not liable to the land trust’s trustee or to any other beneficiary for the beneficiary’s good faith reliance on the provisions of the trust agreement. A beneficiary’s duties and liabilities under a land trust may be expanded or restricted in a trust agreement or beneficiary agreement.

And finally, any non-related personal judgement against the Trustee or non-related personal judgements against another beneficial owner cannot be collected from the land trust itself (other than their personal share), therefore preserving the Land Trust without having to liquidate it entirely to satisfy any other owners or trustees non-related personal judgements. In other words, a court may take the defendants interest in the Land Trust, BUT may not seize any other owners interest in the Land Trust to satisfy the judgement or cause it to fully liquidate just to satisfy a particular parties non-related personal judgement

689.071 8(d) The trustee’s legal and equitable title to the trust property of a land trust is separate and distinct from the beneficial interest of a beneficiary in the land trust and in the trust property. A lien, judgment, mortgage, security interest, or other encumbrance attaching to the trustee’s legal and equitable title to the trust property of a land trust does not attach to the beneficial interest of any beneficiary; and any lien, judgment, mortgage, security interest, or other encumbrance against a beneficiary or beneficial interest does not attach to the legal or equitable title of the trustee to the trust property held under a land trust, unless the lien, judgment, mortgage, security interest, or other encumbrance by its terms or by operation of other law attaches to both the interest of the trustee and the interest of such beneficiary.

As you can see, holding each of your properties inside their own separate Land Trust is a much preferred method of ownership compared to a general or limited partnership, or even a sole proprietorship because it serves to limit some liabilities, and certainly prevents other owners personal judgements from completely destroying the Land Trust itself. Care should be taken in the Trusts (Private) Operating Agreement as well as the (Public) Warranty deed to clarify that the Trust is Organized under Florida Statute 680.071, and is specifically a Personal Property Trust (or a Real Property Trust) as you determine will be the most applicable to your plans.

And for even better News: If you have a self directed IRA, you can buy and hold rental or investment property in it, as long as you or your lineal descendants do not use it or live in it. The best vehicle is holding each property in a separate LAND TRUST, which has a few additional benefits as described above. This allows you to use the money inside your IRA for investments, and it will accumulate profits tax free. Your IRA will be the owner of the Land Trust, and if you have a simple self directed IRA, your IRA Trustee will also be the Trustee of the Land Trust, and at your death, the beneficiary will be your Living Trust, or anyone you so designate. Some IRA Custodians may charge a fee of $100-200 per year to hold this asset for you inside your IRA and handle paperwork.

But here is something most people do not know about. Many self-directed IRA’s allow you to setup what is called a “Checkbook IRA” which allows you to control the buying and selling of properties and handling its paperwork at your discretion (following the IRS Rules), instead of the higher expense and delay of having to pass on every piece of paperwork to your IRA Custodian.

What happens is that your Personal IRA is allowed to form its own LLC company for purposes of investments and you can manage all its own paperwork yourself instead of your IRA Custodian (subject to IRS Rules). So your IRA is the Equitable Owner of the LLC, and the LLC actually is the Equitable Owner of the Property in the Land Trust. It is all still owned within your Personal Self-Directed IRA.

But you can expand even more upon this! Naturally each individual has their own IRA, but if a Husband and Wife each convert to a Self-Directed IRA, then each IRA can hold 50% of that single LLC we are talking about, and each IRA can make half of the contributions into the LLC to buy properties, and each IRA will receive 50% of the profits into it. You can even mix and match Roth and Standard Self Directed IRA’s.

OR, if you have a few trusted business partners who have their own Self-Directed IRA’s, each one can invest in a percentage of the single, separate LLC (2 IRA’s = 50% each, 4 IRA’s=25% each).

In either case of 2 or more individual IRA’s holding a percentage of a single LLC, this give you more cash inside the LLC to invest tax free, limits additional paperwork and expenses, and even more importantly, creates a fully protected Multi-Member LLC which has complete protection against charging orders which might flow into any of your personal assets.

For State Approved Legal Forms CLICK HERE

More on SELF-DIRECTED IRA’s in the near future.