Forming A New Business

Sole Proprietorship, Limited Liability Corp (LLC), S-Corp, C-Corp, Limited Partnership, General Partnership, or Florida Land Trust ?

Expanding your Ideas and part time money making ventures from the kitchen table to a full time operation can be a daunting process for most individuals, and you should carefully outline your goals and study as much information as possible about the best way to achieve your objectives.

Once you have developed a product, service or investment opportunity that you would like to market, it is important to determine the best type of business entity to use to obtain your goals, and then register to do business under that format. There are a wide variety of different formats, and each one has its unique advantages as well as limitations or specific operating requirements.

You can do this yourself, or there are Business Consultants that can assist you in some or all of these details for reasonable fees. Then make a final check with your Attorney and Tax Accountant to make sure your plan is designed in the most advantageous way to protect, enhance, and blend in with your family’s other finances, assets, Trusts, and other matters. Our Publications Section will display additional Books, Publications, Software and other Materials which cover each of these specific Categories in great detail.

SOLE PROPRIETORSHIP

This is the simplest form of business when you are planning to run your business as an individual without any other partners or employees. As long as you operate under your own last name, there are no state forms or annual reports to file. Examples of business names would be “John Doe Handyman Service” or “Interior Designs by Jane Doe”. or “Bob Smith Investments”.

If you prefer to operate under a completely separate Trade Name, you would simply have to file a Fictitious Name Registration with your secretary of state and pay a small annual fee ranging between $7 and $25, but once again, no other annual reports or fees are required with the state. Each state maintains a list of Names that are in use, and you need to search that database to make sure your planned business name is still available.

The only other item required from the state would be a Sales Tax Number if you are planning to sell physical Products to residents inside your own state. This is generally not required for any business offering only Professional Services, or Products being Drop Shipped to other states (although this is gradually changing), and you will have to submit a report of sales tax collected and send this in along with the taxes collected on an annual or quarterly basis, depending upon your sales volumes.

With a state sales tax number, you will be able to purchase products and supplies from vendors without having to pay sales tax, but when you sell the products, you are required to collect the proper amount of sales tax, and remit it to the state.

Next, you need to check with your local county and city to see what type of Local Business License you might need for your proposed business. There is usually a very small annual fee of $25-$50, but for some occupations that require additional professional state licensing (such as Real Estate Agents, Contractors, Plumbers, Electricians, Nurses, etc) , it can be somewhat higher. In many counties, the fee for a local business license is waived if you are over the age of 65, but you must still register each year with your current name and address information.

All Income and Expenses are reported under your personal Social Security Number on your annual Federal Form 1040, using a Schedule-C attachment. There are additional supporting forms for buying, renting and selling Real Estate, mileage expenses for your personal vehicle, or for the Purchase of a vehicle dedicated to your business, but the entire results all ends up in the Schedule C Form.

Your Tax Preparer will have all of these forms, or if you are using an automated program like TURBO TAX, all of these forms and much more are generated for you. It is very important to keep your business expenses on a separate credit card or separate checking account so you have clear records available in the event of any audits.

Tax Liability and Personal Liability

of the Sole Proprietorship rests solely with you as an individual and any fines, liabilities or legal judgments associated with the business will be subject to payment from your family funds or by attachment and liquidation of your personal assets.

Likewise, if you are personally involved in an accident or legal suit for damages and have a judgement filed against you, that party can attach and seize the assets of your business if your personal insurance cannot pay the entire judgement amount. Legal judgments can flow both ways, so if you feel you are in a high-risk business, it is very important to obtain a small Business Liability Insurance Package of $100k to $500k for a few hundred dollars a year.

GENERAL PARTNERSHIP

This type of organization is formed when more than one person plan to own and operate a business. It operates similar to a Sole Proprietorship with a few important differences, as well as liabilities.

Each member contributes an agreed upon amount of cash or services to the General Partnership, in exchange for a certain percentage of ownership and share of the profits. These contributions do not have to be equal shares. A husband and Wife may each own 50% of the shares together, or for tax reduction purposes they may each own 30% of the shares, and provide the remaining 40% among their children. Also, a group of ten (10) like-minded entrepreneurs might each contribute the same amounts of cash in exchange for 10% shares in the ownership and profits.

Management, Tax Liability and Personal Liability

of the General Partners differs considerably from the Sole Proprietorship. all partners must agree on every decision, and co-sign every business contract and provide personal financial statements to a bank for a loan. Without a very detailed Operating Agreement signed by all members, any individual partner can conceivably sign a document that will legally bind all other partners.

A major difference from a Sole Proprietorship, LLC, or Corporation is that liabilities flow in all directions. If the General Partnership is sued in any matter during its course of business and receives a court judgement, all members will be named as a defendant and the plaintiff is entitled to collect his judgement by attaching not only assets of the General Partnership, but ALSO from each and every individual’s personal family assets as well!

The same will be true for delinquent IRS underpayments, or unpaid state sales taxes which may be due if the Partnership has insufficient funds to satisfy the judgement. Even worse, is that if you or any other member are personally sued for matters completely outside the nature of the General Partnership (personal legal suit, Car Accident, Divorce Settlement, IRS, Probate, Bankruptcy, etc), the plaintiff has the right to satisfy the judgement by liquidating the shares of that individual partners interest in the partnership, which may effectively cause the entire organization to fail. As you can see, this is the most undesirable form of business organization to choose.

LIMITED PARTNERSHIP

This is much safer way to organize and the state and local registration, fees, annual reports and licensing requirements are similar to the General Partnership, Limited Liability Company and Corporations, but the organization is set up in two parts, with one General Partner, and several Limited Partners.

Usually there is one strong developing partner who will mainly be selected to provide the daily front end management, makes all decisions, and signs all contracts and loan applications. The rest of the partners do not actively participate in the daily management, but meet regularly to vote on current issues and will share in all profits in direct proportion to their cash contributions.

The General Partner usually provides his services in exchange for his certain percentage of contribution instead of cash (or he could be compensated additionally for his efforts.) For example for a start-up company raising $ 100,000 in start-up capitol, the General Partner might hold 20% ($20,000 value) for his management services, and 4 other Limited Partners might each contribute $25,000 ($100,000 total) but each of the 5 partners personally receives a 20% share of the company. The company files a separate federal tax form and the General Partner and all Limited Partners share equally in any profits in proportion to their ownership shares. There can be many variations to this.

Tax Liability and Personal Liability

is substantially different in a Limited Partnership. The General Partner assumes all of the liability for acts of the company, loan defaults, foreclosures, bankruptcy, lawsuit judgements, IRS liens, etc, and the limited partners are held completely harmless.

The limited partners cannot have their personal assets attached, their credit ratings destroyed, and they are not required to ever contribute any additional cash or capitol to the company if it cannot satisfy its judgements. Their only risk of loss is their value in the stock in the event of liquidation.

LIMITED LIABILITY COMPANY

This is by far the most popular type of organization today and is the organization of choice used by the majority of small and medium sized businesses across the country. It is easily formed, simple to operate, and does not have to file and pay its own federal Income Tax, saving a great deal in annual accounting fees.

At the end of the year it fills out a simple IRS Form 1065 stating the total income and expenses, and the percentage of income or loss credits that each member is entitled to. Then a Form K-1 (which is similar to a Form 1099) is sent to each member showing the amount to to add to their Misc Income/Loss line on their personal IRS Form 1040. It also has some very unique tax-saving features.

LLC’s also have the unique ability to state that they intend to be viewed and taxed by the IRS as a Partnership, Subchapter-S Corp, C-Corp, other other forms, so you can adjust taxation depending upon how large or small your income is expected to become.

Organization and Interests

All owners are called Members, and there is one Managing Member appointed by the group who conducts the daily business activities, contracts, etc, and the rest are just Non-Managing members. The shares can be divided equally accordingly to cash contributions (or services provided), but unlike any other type of organization, the profits or losses can be divided dis-proportionally among the members, and changed each tax year. THIS IS A VERY, VERY BIG DEAL, and not available in any other form of business ownership!

For an LLC consisting of 5 Members, you might distribute income/loss equally to each, however if the LLC is just a husband with a very high income and a wife with very low income (each holding 50% of the shares but filing separate 1040 returns) you might distribute 30% of the income to the husband and 70% of the income to the wife to lower overall taxes.

Even better, if it was a family of six (with 4 adult children filing separate tax returns) you the husband and wife might each hold 48% of the shares and each child hold 1%, but for tax purposes you could distribute 1% of the income to the husband, 1% to the Wife, and 24.5% to each of the four adult children, vastly reducing the overall tax bill.

Personal Liabilities

In a Limited Liability Company (LLC) with two or more members there is even more great news! Unlike the Sole Proprietorship and General Partnerships (where your individual assets are attachable), the Limited Partnership (where the General Partners personal assets are attachable), and the Sub-Chapter S or C-Corporation (where the Directors and Officers personal assets are attachable), neither the Managing Members personal assets (except for fraud) nor the Non-Managing Members personal assets are attachable in a public judgement directly against an LLC with two or more members. Here are a few examples:

Example 1 – A judgement is obtained against an LLC and the plaintiff receives a charging order to seize and sell all interest, stock and assets in the LLC to satisfy any judgement not covered by insurance, which could cause the entire LLC to be liquidated. If the LLC the sale of assets is not enough to satisfy the judgement it stops there.

Example 2 – A judgement is obtained against one member of a multi-member LLC which is not even related to the LLC (car accident, personal injury suit, divorce settlement, etc). A charging order can be obtained to receive ONLY that members percentage interest or share in the LLC’s interest and to receive any possible dividend payments and nothing more. They cannot force the LLC to liquidate to pay off that judgement.

And as long as the LLC’s operating agreement states that the managing member has sole discretion as to when and where to make interest and dividend distributions, and that it takes 85% of all voting members to change managing members or operating agreements, the party seizing the shares cannot receive any cash or payments (other than any interest and income distributed) and cannot vote themselves into the managing member position to change that rule. And they cannot touch any of the rest of the LLC, nor collect from the personal assets of any other member of the LLC.

Worse yet, if the LLC is making money, the judgement creditor will receive an annual K-1 for his share of the profits and must pay additional IRS taxes on his 1040, but wont be receiving any interest or dividends (until determined by the Managing Member). And if the LLC is losing money, that judgement creditor may be required to contribute additional capitol to the LLC (if it is written into the LLC's operating agreement). In these cases, a judgement creditor will simply accept any insurance payment from the judgement debtor and simply go on their way.

Example 3 – If the LLC only has a single member and it receives a charging order to satisfy a judgement, the plaintiff may possibly use what is called “the rule of mergers” to claim that the member and the LLC are are the same exact party and therefore if there are not enough assets in the LLC to satisfy the judgement, they may possibly move further and try to attach the personal assets of the member as well. That does require a lot more work from the creditors attorney, and most of the time it is not done and the amount of any insurance policy is simply accepted.

But there is still a solution – If you are really worried about running a high liability business and you are a single person LLC, you still have two additional protection options for your personal assets.

Wyoming or Nevada or Delaware LLC

The first one is to form your LLC in which specifically protect single member LLCs in the same identical way multi-member LLC’s are protected (as described above), then register them to do business in your state. Wyoming has the strongest single-member LLC laws on the books, costs about $150 to form, and about $50 per year to renew (including registered agent). Your state fee for registering as a foreign company doing business in your state will be about the same as a normal LLC in your state.

Also, Wyoming has no annual State Tax or other reporting requirements (other than name of manager/director) and you only declare any profits and losses for its Federal Income on a simple IRS Form 1065, and issue K-1’s to yourself for your Personal 1040’s as “additional income”.

Additionally, if your LLC receives a judgement against it in your state, that attorney will likely recommend to his client to accept insurance payment, because in order to proceed with a charging order, he would have to file it the home state of the LLC (Wyoming for example), and in order to do that, he would also have to be licensed to practice law in that state (which he is probably not), so then he will then have to either pass the case off entirely to a state licensed attorney , or coordinate it with that attorney all the way to completion with a second attorney in the LLC’s state (Wyoming, as an example).

The second option for a single member LLC

is to simply create a resolution in your corporate books to ADD a family member (such as your mother, father, child, etc) as a member of the LLC and give them a 1% share in the LLC, with the LLC having the first right of refusal to buy it back at any time in the future for $1 or other consideration. Because LLC’s can disproportionately assign actual income, you can set their annual distributions to zero (or a small amount if they are not actively participating), so they don’t have to become involved in any K-1s or other tax forms. Now you are a multi-member LLC.

Additional LLC Distribution Benefits

As your LLC grows and accumulates cash and assets, you may remove some or all of your initial cash invested as EQUITY without having to pay any taxes. This is completely unlike Corporations issue Stock Shares for initial investments, and any money distributed back to you is always in the form of DIVIDENDS, which is TAXABLE a for a second time on your personal income tax when you receive it. Money in Corporations always has a double-taxation.

Additional LLC Deduction Benefits

Just like Corporations, even your small LLC can set up medical and retirement plans, pay for special medical expenses for some of its key its employees, buy and fully depreciate or write off trucks, automobiles, machinery, computers printers, and any other type of equipment needed in the course of business.

Up to 80% of this can be immediately EXPENSED each year, and deducted from the LLC’s total Income. The remaining 20% can be carried forward each year until it can be applied to a future year’s income.

But the real advantage with a LLC becomes apparent when those final net income/expense amounts are ultimately passed directly on to each individual members IRS Tax Form 1040 in a K-1 (proportional to their shares), allowing them to greatly reduce their own tax liabilities because they are now in the lower tax rate tables. By far, an LLC is the most desirable form of business operation.

SUB-CHAPTER S CORPORATION

An S-CORP is somewhat similar to a Limited Liability Company (LLC) in it does not pay its own Taxes, but instead it files a IRS Form 1065 at the end of the year and passes all of the Income/Loss credits to each Shareholder in the for of an IRS Form K-1.

Unlike a C-CORP, an S-Corp is limited to 100 shareholders and can issue only a single class of stock. The operating structure is different however in that it must have DIRECTORS who meet and determine the operation and policies of the CORP, appoint the OFFICERS (President, Vice President, Secretary, Treasurer), and the SHAREHOLDERS, who have made the financial investments and hold shares of stock proportional to their contribution.

In a small S-CORP, one person can hold all positions of Director and Officers, but in that case liability is limited. The main difference in the S-CORP is that while all of the Shareholders personal assets are protected from public judgements against the S-CORP, all of the personal assets of the Directors and Officers CAN be attached in such a suit, and they can be named Personally as a Defendant in a CORP lawsuit. This is why all Corporations need not only Liability Insurance for the CORP, but also Errors and Omissions Liability Insurance for each of the Directors and Officers

So the differences in an S-Corp and a LLC is that it is more expensive to maintain and operate, has more state forms to file, franchise fee to pay, AND any or all of the Directors and Officers can always be added personally as an additional defendant in any lawsuit against the company, since they are directly responsible to the public for all management decisions and actions that cause harm.

One other difference is that an S-Corp can declare a salary for officers (which requires the 15% employer tax portion) and declare the rest of the net profits as dividends (which does not have that tax). All net profits in an LLC are passed on to members and considered as “additional income” and taxed accordingly.

This particular difference is not usually a problem however, since in both cases, the law now allows you to EXPENSE and deduct the value of all purchased equipment, cars, trucks, tools, other vehicles, etc as an standard expense in the year that they were purchased, instead of having to depreciate them over several years.

C-CORPORATION

A C-CORP operates exactly like an S-CORP except it is usually designed for much larger organizations and Public Companies that might have hundreds or even thousands of Investors. The stock it issues to Investors is usually in either Preferred Groups (with voting rights and other features) or Common Stock (without voting rights).

A C-CORP operates under its own Federal Tax ID and pays its own taxes. It can also withhold cash reserves for projected operating needs, and if and when it decides to distribute profits to Investors, it is always in the form of a DIVIDEND, which the Investor must report on his personal Form 1040 and pay to required taxes.

Just like the S-CORP, all of the Shareholders personal assets are protected from public judgements against the C-CORP, but all of the personal assets of the Directors and Officers CAN be attached in such a suit, and they can be named Personally as a Defendant in a CORP lawsuit. This is why all Corporations need not only Liability Insurance for the CORP, but also Errors and Omissions Liability Insurance for each of the Directors and Officers

FLORIDA LAND TRUST

A Florida Land Trust is a unique and perfect method to buy, sell and hold Property while limiting and separating liability and dealing with multiple partners without having to form a Partnership, LLC, or Corporation. It basically treats the property as a personal asset, but retains all of the best rules of protection for both personal and real estate and adds a few more. (as described below).

There are 6 states that allow Land Trusts that contain the special features for Real Estate (Florida, Hawaii, Illinois, Indiana, South Dakota, and Virginia)

It is exceptionally simple to form and requires no federal, state or local filing or reports. A few additional benefits of holding property in a LAND TRUST instead of an LLC or other form of ownership is as follows:

A very important benefit is that you can place your existing home or investment properties into separate LAND TRUSTS (with you and/or your wife as Beneficial Owners) without causing your mortgage to be accelerated by a bank (this is Federal Law 12USA 1701J-3 )

If you live in the property, you will be able to retain your Homestead Exemptions. (this is also true holding property in a Living Trust, but in an LLC you lose those exemptions)

Your Owners Title Policy, Lenders Title Policy, and Property Insurance will remain the same and carry over in the name of the Land Trust. Transferring into an LLC will require new policies.

Because the Land Trust is treated as an asset known as a Grantor Trust, you can sell or transfer all of, or a percentage a percentage of the entire Trust to another party very quickly, quietly, and privately without having to file any documents with the county. This is done by using a simple Bill of Sale of the Land Trust (instead of a full property closing) and without having to incur new closing fees, title insurance, property insurance, etc.

There are two exceptions: If the equitable owners have changed, the new Trustee will have to pay a DOC STAMP FEE for the declared value of the exchange, and if the Name of the TRUSTEE changes, the old TRUSTEE will have to sign and provide a NEW WARRANTY DEED to the new Trustee, which transfers power and authority to the name of the new Trustee of the Land Trust, along with his new address for contact (filing cost about $20)

Of course YOU PERSONALLY, or any other type of organization (such as LLC, TRUST S-CORP, C-CORP, etc) can act as a TRUSTEE of the LAND TRUST, but for those who prefer to remain very private, you can form a second Land Trust (under Section 689 of Florida Statutes or Grantor Trust which allows that trust to hold or manage personal assets), and that second Trust will have NO ASSETS in it. Its sole purpose is to ONLY to act as a TRUSTEE for other TRUSTS.

You are the equitable owner of the second trust (but your name is not shown in any county record), and the name of the second Trust is shown as TRUSTEE on the original LAND TRUST. Of course, any authorized party within the second Trust (you or a designated agent) can sign as an agent for the TRUSTEE on matters related to the original LAND TRUST.

THERE ARE FOUR PARTS TO A LAND TRUST

1- The Equitable Owners of the Land Trust, who can be an Individual, a Family Living Trust, a Self-Directed IRA, Two Separate self directed IRA’s (Husband and Wife IRA’s) each holding 50% ownership, a Group of Unrelated Individual Investors, a Limited Liability Company (LLC), S-Corp, C-Corp, or Partnership. No matter who they are, each one holds a share of the LAND TRUST equal to their cash (or other) contribution.

2- The Operating Agreement – Which is drawn up among the Equitable Owners states how the Land Trust will be organized, how much percentage of ownership each equitable owner holds, who will MANAGE it, and who will be the TRUSTEE. This is a private non-public document that should be Signed and Notarized by all Equitable Owners and Trustee, and copies provided to each person.

It is not required by law to be filed in the county records, and you should NOT do so, since it will provide a level of privacy for all the Owners. You can name the Land Trust anything you want, such as 123 Main Street Trust, Sunshine Trust #1, etc, and you do NOT have to register a fictitious name with the state because you are declaring a TRUST in the Warranty Deed

3- The Trustee – This is the person that holds technical title (but not Equitable Title) to the Land Trust, and is responsible (at the written direction of the beneficial owners) for signing all legal documents to transfer title at the time purchase and time of sale, and who is designated as the legal point of contact for the Trust.

This is similar to when a home has a mortgage, and a Trustee has to sign paperwork or release Warranty Deeds in the future sale. In those cases a BANK (or Trustee or designated agent acting for the Bank is named) signs to transfer title.

The Trustee is given limited fiduciary powers by the Equitable Owners in the written Operating Agreement, which usually involves signing deeds or documents at the specific written directions of the Equitable Owners. A Trustee can be one of the Equitable Owners, a Trusted Third Party Fried, Family Member, Business Associate, LLC, Partnership or Corporation.

4- The Warranty Deed – When the property is initially purchased the Warranty Deed is recorded in the county. There are only two names on the Deed – the Name of the LAND TRUST, and the Name of the TRUSTEE as fiduciary contact. This is the ONLY DOCUMENT that you have to file with the County, so it formally recognizes the Name of the Trust and the Name of the Trustee. You do not need to disclose anything else, and it costs about $20 as a one time fee to have it recorded. An example is shown below

123 Main Street Trust, Trustee John Smith (Trustee is an Individual)

123 Main Street Trust, Trustee Sunshine LLC (Trustee is an Organization)

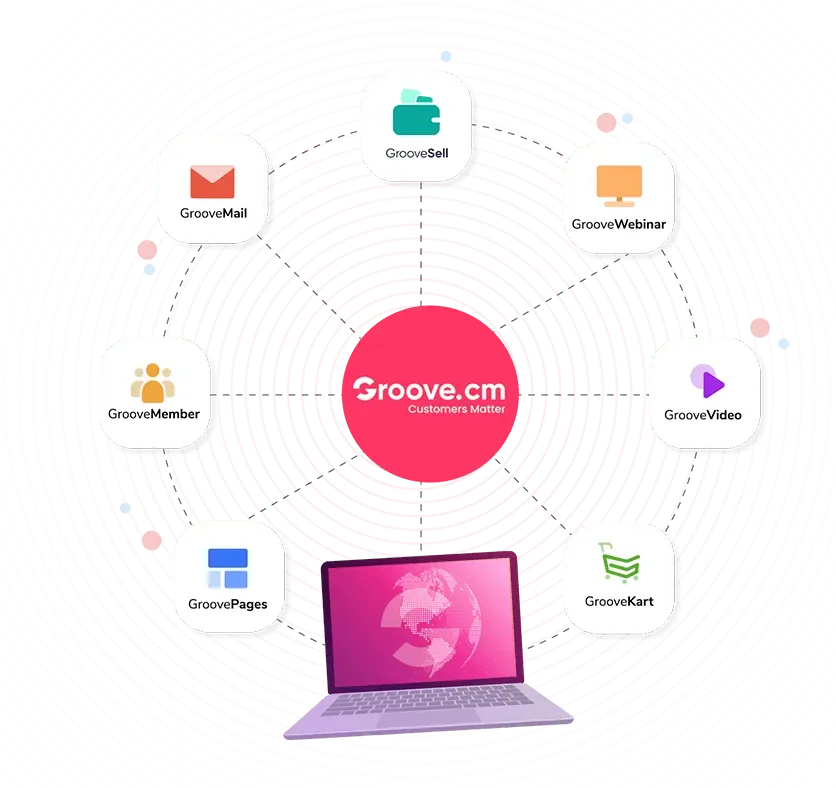

A Chart showing the Organization of a Florida Land Trust is Shown Below (More Information)

FLORIDA LAND TRUST CHART

Also, Florida Land Trusts are governed under Florida Statute 689.071 and may be organized as either Personal Property (the usual choice), or Real Property, and it affects what types of laws apply.

Many people do not realize that there are several special provisions in the Florida Land Trust Statutes that serve to limit liability of each beneficial owners personal assets. Normal Revocable Trusts generally allow for full pass-thru liability under section 736 of the statutes, HOWEVER Land Trusts organized under 689.071 have several special protections for the owners and the Trustee.

Section 689.071(12) states DETERMINATION OF APPLICABLE LAW.—Except as otherwise provided in this section, chapter 736 does not apply to a land trust governed by this section.

Going forward, section 689.071 8(a) generally prevents liabilities and judgements against a Land Trust from being collected from individual beneficiaries personal assets unless they have been personally involved in the active management. That means any judgements can only be levied against the assets INSIDE the Land Trust itself (which is usually just one property) and does not pass thru to all the owners other individual personal assets. It reads as follows:

689.071 (8)(a) LAND TRUST BENEFICIARIES.—Except as provided in this section, the beneficiaries of a land trust are not liable, solely by being beneficiaries, under a judgment, decree, or order of court or in any other manner for a debt, obligation, or liability of the land trust. Any beneficiary acting under the trust agreement of a land trust is not liable to the land trust’s trustee or to any other beneficiary for the beneficiary’s good faith reliance on the provisions of the trust agreement. There are limitations however. A beneficiary’s duties and liabilities under a land trust may be expanded or restricted in a trust agreement or beneficiary agreement.

And finally, any non-related personal judgement against the Trustee or non-related personal judgements against another beneficial owner cannot be collected from the land trust itself (other than their personal share), therefore preserving the Land Trust without having to liquidate it entirely to satisfy any other owners or trustees non-related personal judgements. In other words, a court may take the defendants interest in the Land Trust, BUT may not seize any other owners interest in the Land Trust to satisfy the judgement or cause it to fully liquidate just to satisfy a particular parties non-related personal judgement

689.071 8(d) The trustee’s legal and equitable title to the trust property of a land trust is separate and distinct from the beneficial interest of a beneficiary in the land trust and in the trust property. A lien, judgment, mortgage, security interest, or other encumbrance attaching to the trustee’s legal and equitable title to the trust property of a land trust does not attach to the beneficial interest of any beneficiary; and any lien, judgment, mortgage, security interest, or other encumbrance against a beneficiary or beneficial interest does not attach to the legal or equitable title of the trustee to the trust property held under a land trust, unless the lien, judgment, mortgage, security interest, or other encumbrance by its terms or by operation of other law attaches to both the interest of the trustee and the interest of such beneficiary.

As you can see, holding each of your properties inside their own separate Land Trust is a much preferred method of ownership compared to a general or limited partnership, or even a sole proprietorship because it serves to limit some liabilities, and certainly prevents other owners personal judgements from completely destroying the Land Trust itself.

Care should be taken in the Trusts (Private) Operating Agreement as well as the (Public) Warranty deed to clarify that the Trust is Organized under Florida Statute 680.071 (and not General Trust Statute 736), and that it is specifically a Personal Property Trust (or a Real Property Trust) as you determine will be the most applicable to your plans.

And for even better News: If you have a self directed IRA, you can buy and hold rental or investment property in it, as long as you or your lineal descendants do not use it or live in it. The best vehicle is holding each property in a separate LAND TRUST, which has a few additional benefits as described above. This allows you to use the money inside your IRA for investments, and it will accumulate profits tax free.

Your IRA will be the owner of the Land Trust, and if you have a simple self directed IRA, your IRA Trustee will also be the Trustee of the Land Trust, and at your death, the beneficiary will be your Living Trust, or anyone you so designate. Some IRA Custodians may charge a fee of $100-200 per year to hold this asset for you inside your IRA and handle paperwork.

But here is something most people do not know about. Many self-directed IRA’s allow you to setup what is called a “Checkbook IRA” which allows you to control the buying and selling of properties and handling its paperwork at your discretion (following the IRS Rules), instead of the higher expense and delay of having to pass on every piece of paperwork to your IRA Custodian.

What happens is that your Personal IRA is allowed to form and hold its own LLC company for purposes of investments and you can manage all its own paperwork yourself instead of your IRA Custodian (subject to IRS Rules).

So your IRA is the Equitable Owner of the LLC, and the LLC actually is the Equitable Owner of the Property in the Land Trust. It is all still owned within your Personal Self-Directed IRA.

But you can expand even more upon this! Naturally each individual has their own IRA, but if a Husband and Wife each convert to a Self-Directed IRA, then each IRA can hold 50% of that single LLC we are talking about, and each IRA can make half of the contributions into the LLC to buy properties, and each IRA will receive 50% of the profits into it. You can even mix and match Roth and Standard Self Directed IRA’s. This doubles the amount of money available to invest in real estate.

OR, if you have a few trusted business partners who have their own Self-Directed IRA’s, each one can invest in a percentage of the single, separate LLC (2 IRA’s = 50% each, 4 IRA’s=25% each).

In either case of 2 or more individual IRA’s holding a percentage of a single LLC, this give you more cash inside the LLC to invest tax free, limits additional paperwork and expenses, and even more importantly, creates a fully protected Multi-Member LLC which has complete protection against charging orders which might flow into any of your personal assets.

For State Approved Legal Forms CLICK HERE

More on SELF-DIRECTED IRA’s in the near future.